Amazon released their Q3 2021 earnings on October 28, 2021. Here are a few takeaways on the eCommerce giant’s financial results and go-forward strategy:

- Amazon’s massive logistics spending created a big miss on profits. They cited about $2B in incremental covid-driven operational costsdriven by steel, transportation, and trucking. Increased employee wages was also a factor. Operating margins were down more than two full points y/y (4.4% vs. 6.4%).

- Brian O. said they aren’t capacity-constrained by warehouses or trucking anymore. Having brought on more than 100 new fulfillmentcenters in the US (wow), their biggest capacity constraint is now labor.

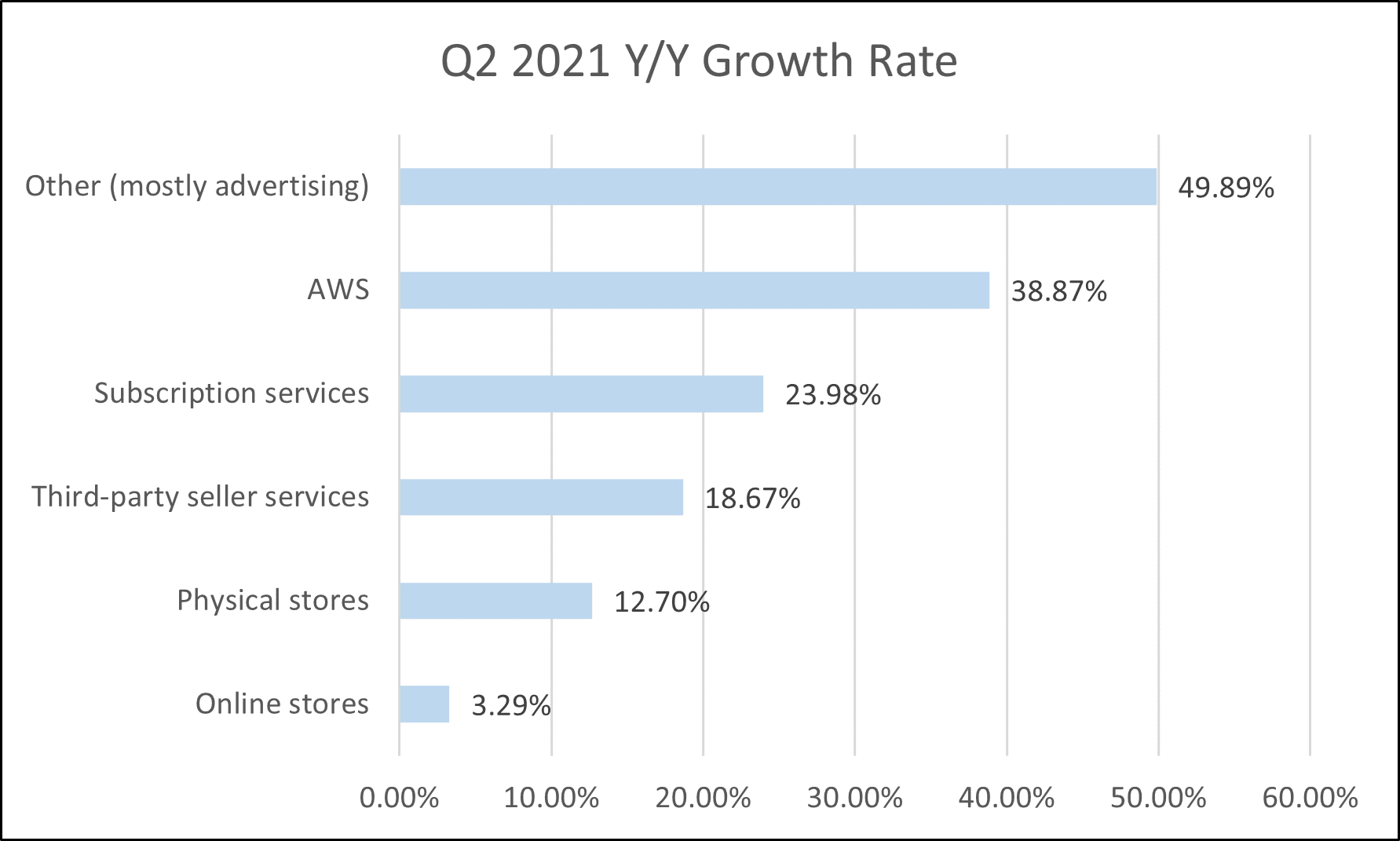

- Their growth is coming from services (now 51% of net revenue). US online and physical stores only grew 3% y/y. Yet, advertising grew 50% y/y, AWS 39% y/y, and Subscription Services 24%.

- AWS was a positive callout, now representing 15% of their business and growing at 39% y/y. A real winner with an operating margin of 30%!!

- The International segment lost over $900M in operating income despite having been profitable for many quarters. This wasn’t explained well in the call, but was likely a result of the $887M fine by the Luxembourg National Commission for Data Protection due to their alleged non-compliance of standards for processing personal data.